In Duplin County, residents are expressing widespread concerns that the county’s new property assessments do not accurately reflect their homes’ true market values. Last week, the Duplin Journal conducted a survey to better understand these community concerns.

In more than 100 responses, homeowners cited no major improvements, aging structures, rural locations, and in some cases storm-damaged or flood-prone land, yet many saw their values double or even triple. Mobile and manufactured home owners were particularly vocal, stating that their properties do not appreciate in value like traditional homes but are taxed as though they do. Several respondents noted that their homes are in disrepair or unlivable yet received significantly inflated valuations. A common frustration was the lack of physical inspections, leaving residents confused about the justification for the increased assessments. While a few acknowledged that the housing market has risen in recent years, they still questioned whether tax assessments should reflect inflated market trends. For most, the revaluation process appears arbitrary, inequitable and out of touch with reality.

Geographic Analysis

Among the respondents, the majority are concentrated in a few key towns, with Beulaville leading at 32 responses — roughly 23% of the total. Warsaw and Kenansville follow closely, with 16 and 14 responses, and Wallace comes next with 13. These four towns alone account for over half (56.8%) of all responses, signaling strong engagement in areas more affected or more vocal about the tax revaluation.

Smaller communities like Rose Hill, Magnolia, Chinquapin, Mount Olive, Potters Hill, Teachey, Sarecta and Faison also show notable participation, while several smaller areas had one or two responses, highlighting how the tax concerns reach even the county’s most remote corners. 46% have lived at their current home for more than 10 years.

Property Value Changes

- Over 95% of respondents said their property values increased

- Most value increases ranged from $30,000 to $150,000

- Some increases were $200,000+

- Several properties more than doubled or tripled in value

- 90% of respondents feel the reval does NOT reflect true market value

- Land-only parcels and older homes also saw significant spikes

- Some saw tripled values, especially in rural or farmland areas

Tax Bill Impacts

- Multiple people reported yearly tax increases of $500 to $3,000 or more were commonly reported

- Only one or two responses indicated a value decreased

- A few others said their value stayed the same, though these were extremely rare.

- One said “It went down a few thousand dollars”

Concerns & Hardship

- Approximately 75.5% of respondents expressed concern about their ability to afford staying in their homes long-term.

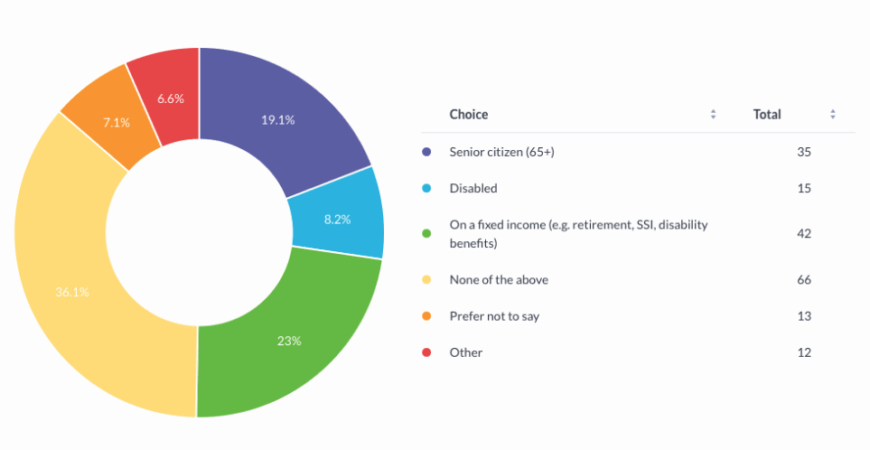

- 25% of all respondents are senior citizens, and 46% are on fixed incomes.

- Many fear being forced to sell family land, going into debt, or being taxed out of their homes.

- The majority of survey responses disagree with the new valuations, with several respondents arguing that the reassessed values far exceed their properties’ actual market value. They cited surrounding property conditions and professional appraisals that contradict the county’s assessments.

Sentiment

- Almost all respondents expressed shock, frustration, or disbelief

- Some describe increases as “robbery” or “insane”

- A few seniors specifically mentioned difficulty affording the new rates

- Many see the tax hikes as disconnected from reality — especially for those on fixed incomes

- There is a widespread perception that the government is not adequately addressing the concerns of residents.

Take the survey here.

Twitter

Twitter Facebook

Facebook Instagram

Instagram